When the Cost of Money Changes, So Does the Value of Art

A Financial Focus Friday post on the impact of rising interest rates on art value.

It’s not news that 2024 saw a downturn in the global art market. According to The Art Basel and UBS Survey of Global Collecting, major auction houses saw sales fall 26% from 2023 and 36% from the market peak in 2021. The downturn is, among many factors, most tangibly connected to the recent rise in interest rates.

The art market has long been a haven for investors looking to diversify their portfolios with tangible assets that appreciate over time. However, rising interest rates have introduced new financial pressures, influencing the way art is bought, sold, and—most importantly—appraised.

Interest rates set by central banks, such as the Bank of Canada or the U.S. Federal Reserve, directly impact borrowing costs, liquidity, and overall investor sentiment. When interest rates rise, borrowing becomes more expensive, reducing the ability of collectors and investors to finance high-value acquisitions. This shift has a ripple effect throughout the art market, influencing demand, pricing trends, and ultimately, how appraisers determine fair market value (FMV).

Appraisers rely on recent sales data, market trends, and collector behavior to determine an artwork’s FMV. When interest rates climb, several key changes occur in the art market:

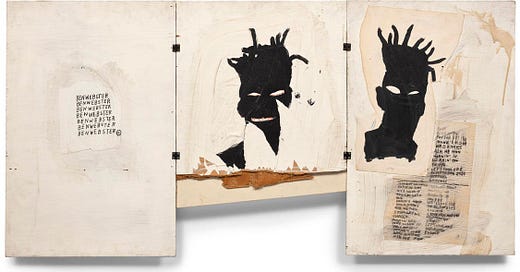

The blue-chip Basquiat does not sell.

No, really. Basquiat’s 1983 Self-Portrait, estimated at $10-$15 million at the Phillips’ Modern & Contemporary Evening Sale was left unsold. At the same auction an Edgar Degas, Andy Warhol, and Edward Hopper also went unsold. Higher borrowing costs lead to decreased bidding competition at auctions. As fewer collectors engage in high-stakes purchases, prices can stagnate or decline, affecting how similar works are appraised.

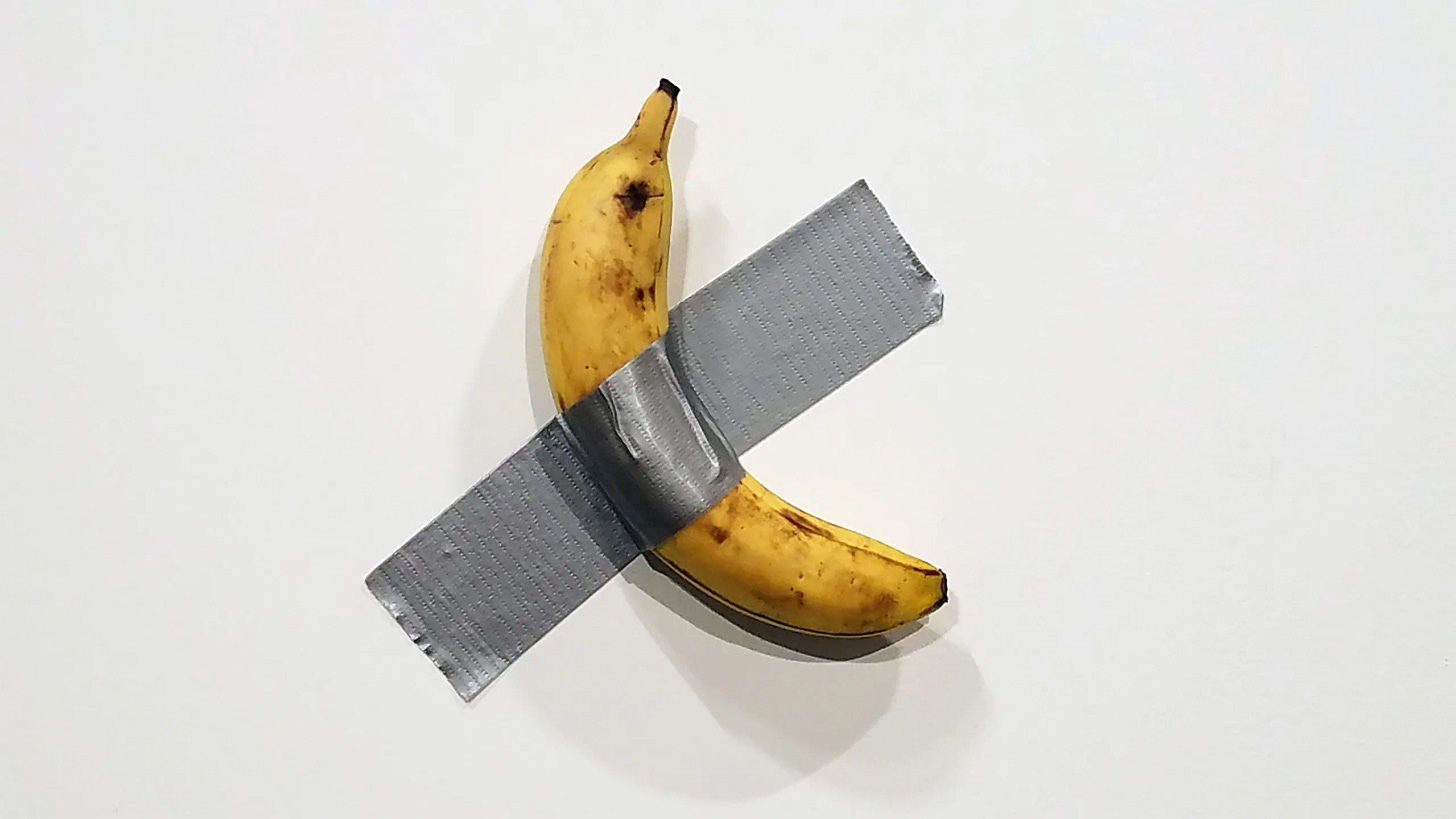

The banana sells.

In times of high interest rates, collectors typically prioritize historically stable or blue-chip artists over emerging talent. However, the current flourishing of tech-millionaires and billionaires has shifted the trend in collecting towards … well… let’s call it ‘more punchy’ artwork. KAWS, Banksy, Invader have all been propelled into the spotlight by the interests of this new type of art collector. Case in point, Chinese crypto entrepreneur Justin Sun’s purchase of Maurizio Cattelan's Comedian. This shift in collectors, collecting, and demand can cause fluctuations in valuation trends that appraisers must account for.

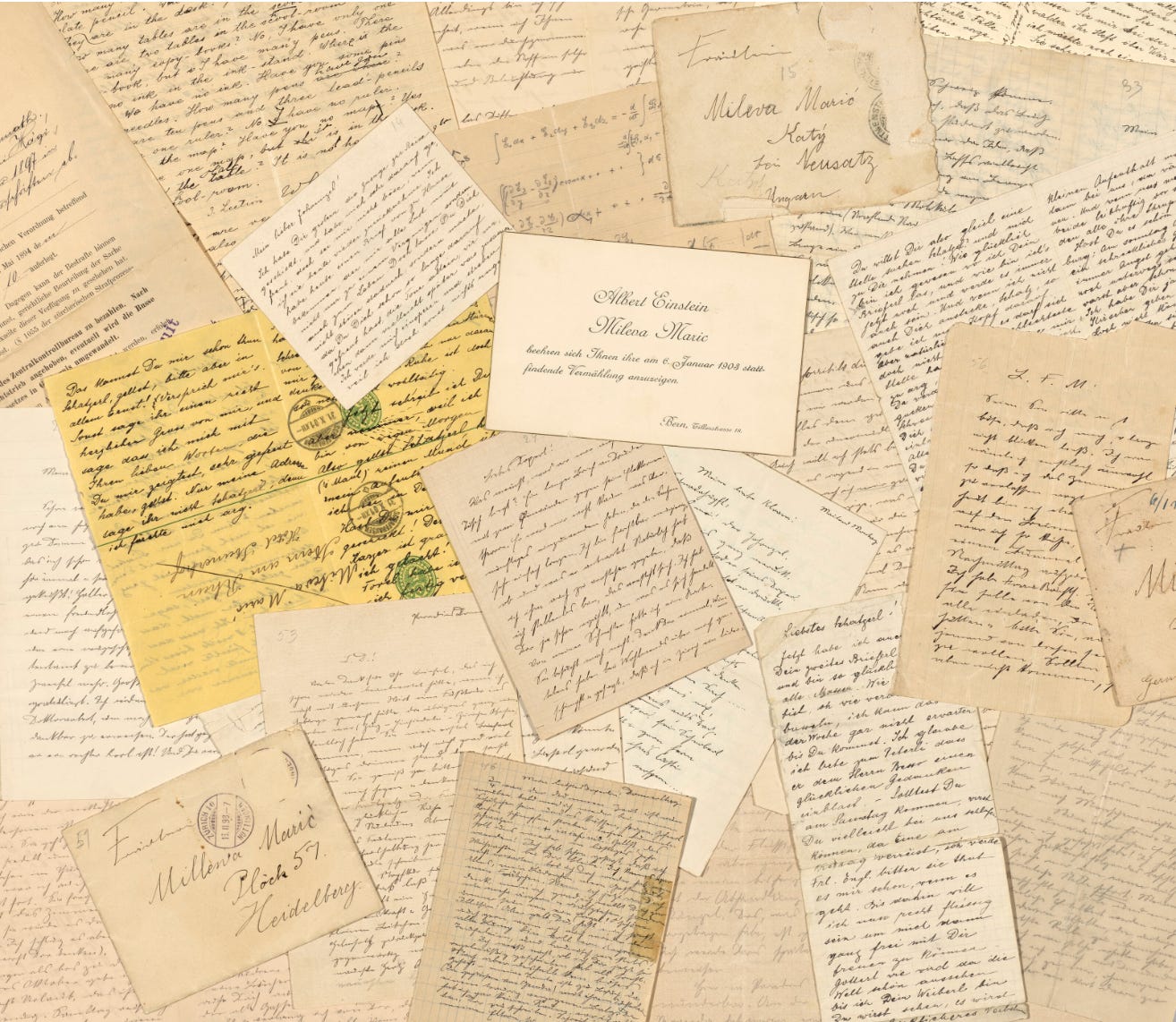

Art-backed loans mean nothing gets brought to market.

A large part of Jacob Safra’s recent legal action against Christie's, in addition to accusing the auction house of bad faith and fiduciary breaches in handling his multimillion dollar art collection (and Einstein’s love letters!!!), is that some of the art brought to auction was listed as collateral in Safra’s other investments and loans. Art-backed loans, where collectors use art as collateral, have become more expensive with higher interest rates. As a result, we will see fewer investors rely on these financial tools, affecting both the frequency and volume of transactions appraisers use for benchmarking value.

In an art market shaped by rising interest rates, appraisers are facing a new landscape—one where blue-chip pieces go unsold, bananas make headlines, and art-backed loans keep major works off the market. Traditional valuation models that rely on past auction results aren’t enough when collector behavior is shifting and liquidity is tightening.

So what does this mean for appraisers? It means looking beyond the usual data points—factoring in private sales, gallery transactions, and changing collector priorities. It means accounting for longer sales timelines and understanding that value isn’t just about historical precedent but about where the market is moving next.

For artists, collectors, and investors, the takeaway is clear: the art market is evolving, and with it, the way we define and determine value. In a market where borrowing costs are high and liquidity is low, appraisers play a critical role in defining value—ensuring that art is priced not just by history, but by the financial realities of today.